Vietnams rice prices near 30-month high on robust overseas demand, thin supply

Despite the gain, Vietnamese rice prices are still around $40 a ton below Thai grain.

Rice export prices in Vietnam, the world's third-largest exporter of the grain, have risen to $400-$410 a ton this week, the highest in nearly 30 months, spurred by robust buying demand from Bangladesh and the Philippines and a domestic shortage of fresh grain between crops, traders said on Thursday.

The price hike should not hurt Vietnamese exporters as they have enough in stock to meet existing contracts, but foreign traders seeking to buy anew from the Southeast Asian nation may have to stay on the sidelines, traders said.

Vietnam's 5-percent broken rice price has risen around 10 percent since the end of May to $410 a ton this week, free-on-board basis, its highest since November 19, 2014 when the grain was quoted at $410-$410, FOB Saigon Port.

Thailand's 5-percent broken rice, the world's second-biggest exporter after India, stands at $450-$460 a ton, FOB basis, which is making Vietnamese rice more attractive, traders said.

"The market situation is like this: buyers want to buy, while sellers are reluctant to sell," a trader at a foreign firm in Ho Chi Minh City said.

The Bangladeshi government has approved a rice import plan from Vietnam, including 200,000 tons of white rice at $430 per ton and 50,000 tons of parboiled rice at $470 per ton, to help cool domestic prices, the Dhaka Tribune said in an online report on Thursday, citing government officials.

Bangladesh, the world's fourth-largest rice consumer, often buys parboiled rice from India, but despite ample supplies in its giant neighbor, it has turned to Vietnam thanks to lower prices, the U.S. Department of Agriculture said in a report this month.

Agricultural production in Bangladesh has suffered heavily from natural disasters over the past two years, including heavy flooding in April. In late May, it signed a memorandum of understanding with Vietnam, under which it will import up to 1 million tons of rice a year until 2022.

Traders in Vietnam said rice export quotations have jumped since the pact was signed, even though no contract for the first 250,000 tons has been finalized.

Last month, the Philippines, a key buyer of Vietnamese rice, also said it would issue a tender to import 250,000 tons of rice in June to boost stocks before the lean harvest season and in preparation for the typhoon season.

“But given the price jump in Vietnam, the Philippines may not rush its tender,” another trader at a European firm in Ho Chi Minh City said. “Nobody wants to play the fool buying while prices are rising.”

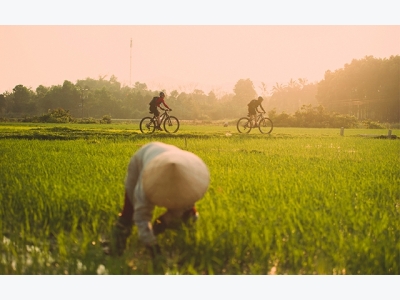

Vietnamese rice prices have risen since farmers in the Mekong Delta food basket finished harvesting their largest crop in a year, the winter-spring crop, with output slightly down due to saltwater intrusion and unseasonal rain, according to government statistics released in late May.

The crop's paddy output is estimated at 9.63 million tons, down nearly 4 percent from last year, the government's statistics agency said.

Besides, with rice shipments picking up in recent months, stocks have fallen.

Vietnam exported nearly 580,000 tons of rice in May, its highest monthly volume since November 2015, the Finance Ministry-run Vietnam Customs said in a report earlier this month.

Total shipments reached 2.36 million tons in the first five months of this year, or 3.3 percent up from a year ago, based on customs data. China alone has accounted for nearly half of Vietnam's rice exports so far this year, up from nearly 40 percent in the corresponding period in 2016.

Vietnam is forecast to export 5.6 million tons of rice this year, up 10 percent from 2016, while shipments are projected to rise to 6 million tons in 2018, the USDA said in its June report.

The report revised up India's rice exports this year by 5 percent to 10.5 million tons, citing recent sales to the Middle East and Africa, while it kept unchanged its 2017 projection for Thailand at 10 million tons.

Có thể bạn quan tâm

Phần mềm

Phối trộn thức ăn chăn nuôi

Pha dung dịch thủy canh

Định mức cho tôm ăn

Phối trộn phân bón NPK

Xác định tỷ lệ tôm sống

Chuyển đổi đơn vị phân bón

Xác định công suất sục khí

Chuyển đổi đơn vị tôm

Tính diện tích nhà kính

Tính thể tích ao hồ

Coffee exports reduce in volume but grow in…

Coffee exports reduce in volume but grow in…  As highlands pepper prices fall, farmers hold out

As highlands pepper prices fall, farmers hold out