Where are aquacultures upcoming investment opportunities?

Investment firms in the aquaculture sector are looking at the seafood industry’s broader canvas for profits instead of solely focusing on biomass.

Investment firms are considering more than biomass when they make financial decisions. Photo: Worldfish

“When we first started looking at aquaculture in 2011, we were primarily interested in investing in biomass,” Aqua-Spark’s Amy Novogratz told attendees at IntraFish’s Seafood Investor Forum. During a panel discussion that featured industry leaders from Ferd Capital, S2G Ventures and Neptune NRCP, she explored the role private capital and investment plays in spurring innovation in the seafood sector.

As Aqua-Spark and its investment peers shift away from biomass production, they stress that the industry still holds incredible opportunity for growth. Despite the global economy undergoing shocks from the Covid-19 pandemic, investors are poised for profits.

What’s on the horizon?

The panellists all stated that there were undiscovered opportunities in the aquaculture sector. The industry is changing dramatically – private investors see ample room for disruptors to make their mark.

For Tone Hanstad, an investment professional with Ferd Capital, big data and AI are the sectors to watch. New technologies that rely on data aggregation and analytics can be applied across the aquaculture value chain. There’s a lot of opportunity to capitalise on. Larsen Mettler from S2G Ventures and Thor Talseth from Nepture NRCP largely agreed with her assessment. Mettler explained that anyone investing in a toolkit of technologies could create a systemic shift in the industry.

The panellists saw other opportunities outside of the tech sphere. Talseth noted that consumer behaviour has shifted during the Covid-19 pandemic. Companies that operate in the food service, retail and home delivery sectors have boomed. Developing new products that incorporate value-adds like convenience could be a way to bring new skillsets and insights to the aquaculture industry.

From Novogratz’s perspective, the big opportunities lie in alternative feeds, fish health and disease monitoring. Feed remains the largest production input for farmers and can carry a huge environmental burden. Though alternative feed products are in their infancy, they will require billions of dollars in investment to produce at scale and bring to market.

Investment in vaccines and diagnostics lags behind investments in other sectors. Photo: MSD

When discussing fish health, Novogratz explained that investment in vaccines and diagnostics lags behind investments in other sectors. Maintaining fish health is crucial in the industry – if producers and companies prioritise it, they will create more profitability for themselves. This investment imbalance needs to be corrected to ensure that aquaculture stays on its development trajectory.

How has the industry changed?

Novogratz and Aqua-Spark’s investment strategies have shifted since the early 2010s to incorporate sustainability, emerging technologies and more links along the aquaculture value chain. She isn’t alone. This pivot is being emulated by the other private investment firms on the panel.

For Hanstad, private capital in the aquaculture space is focusing more on environmental, social and governance (ESG) factors while they pursue growth. She and the other panellists explained that maintaining ESG targets and profitability aren’t mutually exclusive. Aquaculture is one industry where “doing the right thing” can yield better financial and environmental results.

Related news

Tools

Phối trộn thức ăn chăn nuôi

Pha dung dịch thủy canh

Định mức cho tôm ăn

Phối trộn phân bón NPK

Xác định tỷ lệ tôm sống

Chuyển đổi đơn vị phân bón

Xác định công suất sục khí

Chuyển đổi đơn vị tôm

Tính diện tích nhà kính

Tính thể tích ao

The pros and cons of biofloc

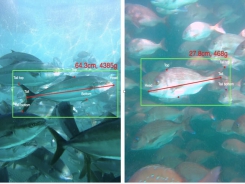

The pros and cons of biofloc  Umitron launches automatic fish measuring system

Umitron launches automatic fish measuring system